About

IIFL is a prominent non-banking financial institution that offers a variety of mortgage and loan services. They offer microfinance, gold loans, home and business loans against property to SMEs. IIFL is an independent full-service institution with 2,372 branches in over 500 cities.

Project Highlights

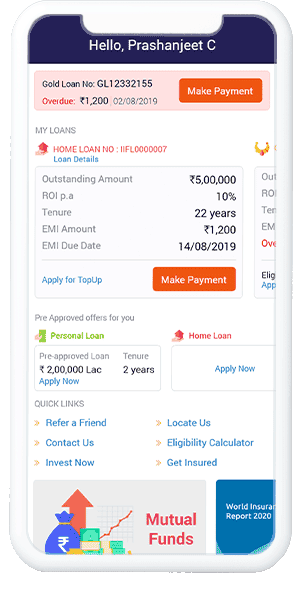

Our developers created a mobile app that allowed IIFL’s customers to experience a flawless loan journey. The team redesigned the application that allowed customers to track their existing loans, obtain account statements, and many more services. Our developer created a loan app.

The Challenges

- Biometric authenticationCustomers need a secure app to protect their financial details.

- Payment gateway integrationSince loan payments vary, there is a constant need for a secure payment integration.

- CIBIL score identificationA high amount of security is needed for any third-party intervention.

- Reformed customer journeyThere was a need for a simplified and organized customer journey.

Tech Stack

Android

IOS

AI/ML

Result

5 million+ active users

Brainvire’s team made necessary changes in the app. During COVID-19, these changes helped improve customers’ loan journeys and IIFL gained over 5 million active users.Over 150 million of loan amount

IIFL has gained over 150 million of loan amount to be managed. With a redesigned customer journey and improved app, customers spend more time on the app. This boosted cross sell and upsell activities.Reduction in footfall at branches

During the pandemic, the app helped customers to learn about their loan amounts, transactions, details, and other activities. 68% reduction of footfall at the branches was observed with this redesigned app.39% fewer support tickets

IIFL staff received almost 39% fewer support tickets with this new app.