Have you considered creating an app for your business?

Ready to find an investor for your app?

Well, before you pitch your business or app concept to investors, you must first conduct some preliminary research.

Investors need to know that you have done serious research on your idea, so simply having a basic notion didn’t replace it.

In addition, they want to see that you’ve studied the marketplace to demonstrate how this will match the direct competitors or how it will succeed.

Here are Some Real-World Funding Options For Your Future App

It’s time to talk to investors once you’ve developed your proposal and have a deeper understanding of the fund — The word “investor” refers to anyone serious about investing in your app.

They are termed ‘investors’ since they invest money and share in your concept, even if they are friends and family or venture capitalists.

Furthermore, they believe that your viewpoint will be successful or to be a part of that accomplishment. So, let us take a look at the various sorts of investors you could come across.

There are several common investor types:

- Personal Network

- Venture Capitalist

- App Funding Contest

- Funding From Angel or Seeds

- CrowdFunding

- BootStrapping

1. Create Personal Network:

If you already have a great idea but don’t have access to VCs, try approaching your personal connections for funding.

Friends, relatives, and individuals who already trust you should be your first port of call for potential investors:

Average annual investment total from each type of investor

Getting help from family and friends is the easiest way to get started. They already know you, trust you, and are invested in your success as well as their own stake in your company.

It’s important to make sure these people are dedicated to helping you achieve your goal. For example, a father might ask his son if he can help with the development costs or pitch in on marketing.

A brother would probably be more willing to lend money than lend time. If you are dealing with friends who have read about how successful app developers have become, they may be more interested in the equity than the money they’re putting in.

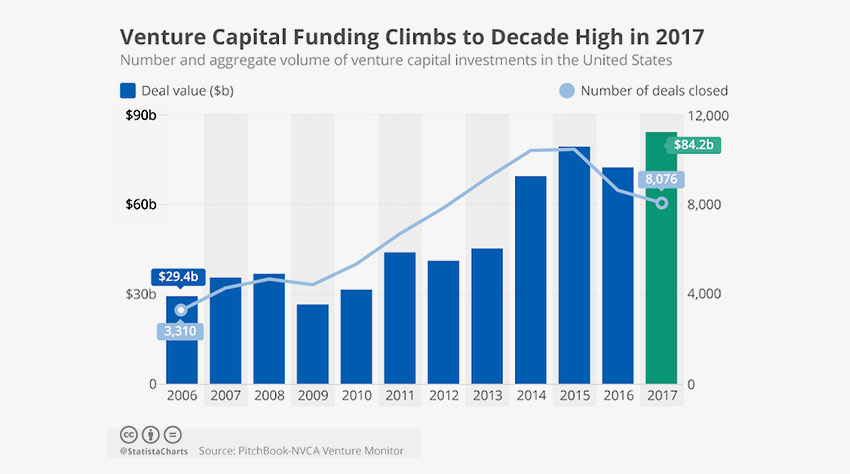

2. Connect with Venture Capitalist:

The terms “venture capitalist” and “VC” are used to refer to any professional investor who is willing to invest capital in a new business enterprise, usually with expectations of an eventual return on their investment that will be greater than the amount invested.

Venture capital is most commonly associated with startup companies and high-tech endeavors, but venture capitalists invest in other types of businesses as well.

Venture capital firms generally comprise one or more partners that together provide several million dollars for a new business, usually in exchange for an equity stake in the business.

The partners have usually experienced entrepreneurs or business executives, and they are responsible for researching the business plan and providing valuable advice to help ensure the success of their investment.

VCs do not normally make direct investments in retail businesses. However, a limited partner (LP) is an investor in a venture capital fund that has made an indirect investment in multiple emerging companies under the management of the fund’s general partner.

The LP receives a share of the profits from successful investments in addition to their capital investment, and almost all venture capital firms start by raising money from LPs before they attempt to raise capital from other sources.

3. Participate in App Funding Contest:

If you’re an app developer but don’t have your own money or access to venture capital, you can try entering an app funding contest.

Appsfunder.com is a community for app developers where they can get help from other developers and also pitch ideas to potential investors who will decide if their project is worthy of any financial backing.

The site has apps pitches and source code that are live in the market. It is also a place for developers to get help and feedback from app industry experts.

App Funding Contest Types:

1. Pitching to Investors

2. Crowdfunding

- Kickstarter: A crowdsourcing website that allows project creators to pitch ideas and raise money from individual investors.

- GoFundMe: Similar to Kickstarter, this site allows users to raise money for different purposes.

- Indiegogo: Another site that allows users to raise money for different projects.

- CrowdGather: A website that brings together many businesses and individuals in one place to create a contest with the winner receiving a financial reward.

- Startup Challenge: An annual event held by the Kauffman Foundation, the winning team receives $20,000.

- Team Building: A contest that draws participants together to create new apps and win a prize.

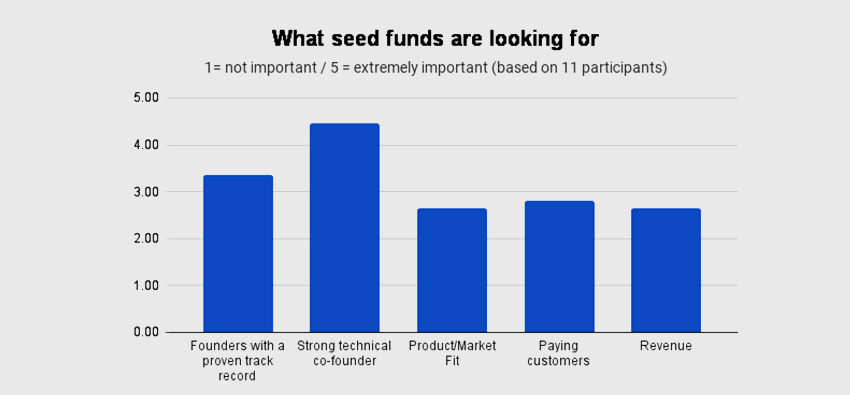

4. Funding From Angel or Seeds: Source of funds for start-up

An angel investor, also known as a business angel, is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. An angel investor’s network may include friends, family, or business colleagues.

A seed round is a term used in venture capital that refers to the first infusion of cash into a company’s bank account from investors.

Seed money typically comes in several million dollars and allows a company to begin operations quickly without having to wait for later rounds of financing.

You are looking for an initial investment of $500,000 to support your startup idea. You can use the seed funding to develop your initial prototype and get a first sales run, which will prove the concept of your mobile app.

The seed stage can take place several times before the company is ready to begin its growth stage. In an app funding contest, a start-up company will have to raise money many times before launching a successful product.

Below are some actions that will assist you in obtaining seed funding.

- Explain your concept, method, and regulations in the absence of whatever financial or burn rate.

- Prior to actually meeting with the seed-stage investor, reach out to the potential purchasers.

- During that period, bootstrap an email campaign or solicit suggestions and comments from app developers.

- Market yourself to funders for application funding by providing data, track records, and confirmation factors.

5. How CrowdFunding can raise money:

Crowdfunding is the collective effort of individuals who network and pool their money together to support efforts initiated by other people or organizations.

Crowdfunding is used in an effort to raise money for a variety of projects such as independent films, new inventions, and charitable causes.

It can also be used as a direct investment tool that helps you fund your app ideas without using traditional fundraising methods that could risk the loss of potential intellectual property or funding control over your idea.

Crowdfunding Sites:

- IndieGoGo: This site is designed for developing businesses with a platform that allows them to create a funding campaign.

- Fundable: A platform for entrepreneurs to raise money for their business ideas.

- Appbackr: This site funds mobile apps and allows them to be downloaded by consumers.

- WeFunder: This site allows users to invest in startups and small businesses that are seeking funding.

Crowdfunding Sites For Mobile Apps:

- Appbackr: This site is similar to RocketHub for the ability to raise money for app projects.

- Crowdfunder: This platform provides potential investors with a business plan for an app project. It then provides information on who has invested and who has not.

- Investors Circle: This website allows investors to invest in other people’s ideas.

- Kiva: This site provides loans to individuals using peer-to-peer donor funding.

1. Donation-based funding:

It is quite a simple yet amazing way of funding. Sites like GiveSmart enable users to gather funds to address specific concerns that have arisen.

It’s a collective effort to raise money that operates online, be it for significant disaster assistance, medical treatments, for example.

The underlying assumption of fundraiser support is that contributors do not anticipate a return or reward in exchange for their donation.

There are several other reward-based crowdfunding platforms online, like Indiegogo. Businesses, entrepreneurs, and even filmmakers use this form of crowdsourcing to secure funding for their development and marketing activities.

Contributors are given some incentive in exchange for their donation, be it early access to an application, a point form, or getting your names in the credits of a movie.

Similar to donation-based fundraising, incentive funding is formed on the notion of getting anything of actual value for a donor’s effort.

2. Investment funding/equity is a simple way to raise funding:

It is another type of crowdfunding. Entrepreneurs raise funds through an equity investment by issuing securities of their firm. It looks close to venture capital investment.

Apart from investment funding, a business that raises funds has total control over what they sell, how much they offer, and other transaction criteria. The investor’s job is simple, invest and profit.

6. How BootStrapping can be beneficial:

Bootstrapping is a way of starting a business with as little capital as possible by using the owners’ time and resources instead of outside funding sources.

Many successful ventures have begun through bootstrapping, including Costco, Dell Computer, Everlane, and Spanx.

The term ‘bootstrap’ comes from the idea of using one’s own boots to pull oneself up by their bootstraps.

The one undeniable benefit of bootstrapping is that you have complete ownership of the application and the workflow. Furthermore, using your money, you may, at the very minimum, develop an MVP to verify your concept.

Frequently, bootstrapping is all that is required for an application to succeed. Finally, it’s a beautiful method to make your hands dirty before meeting prospective investors.

Here are the few things you should do before you pitch your concept to investors

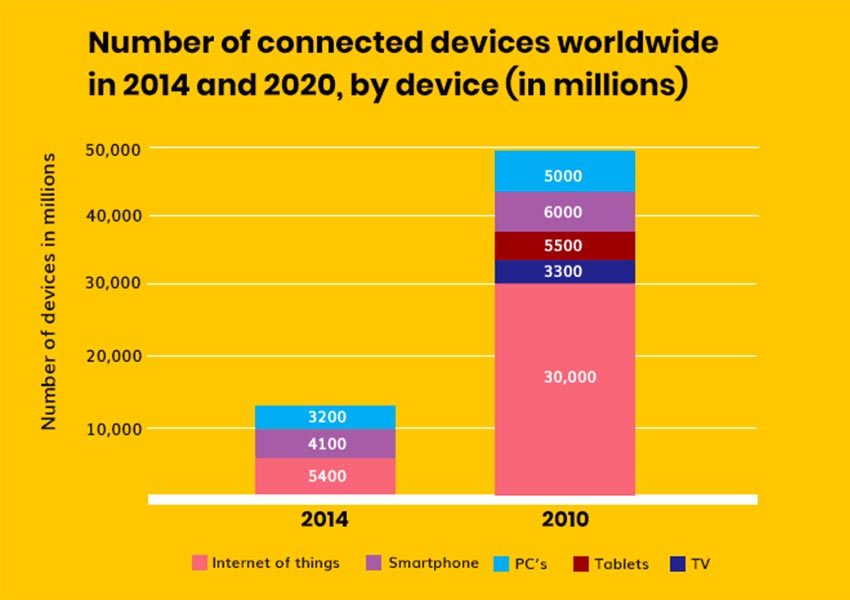

#Understand Your App’s Market

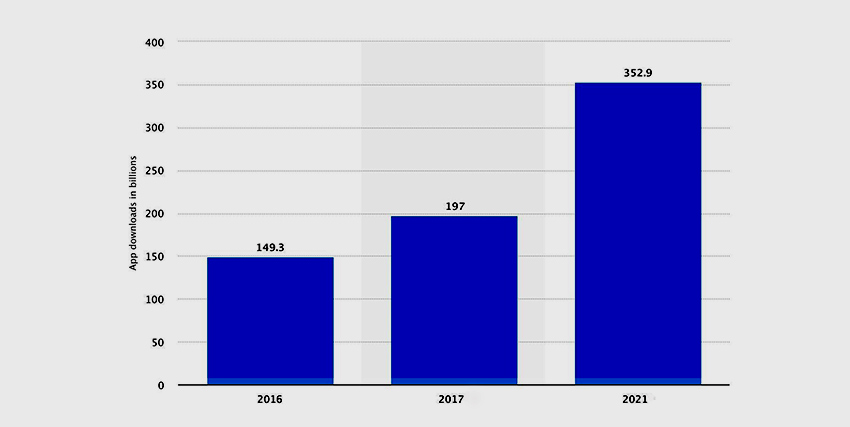

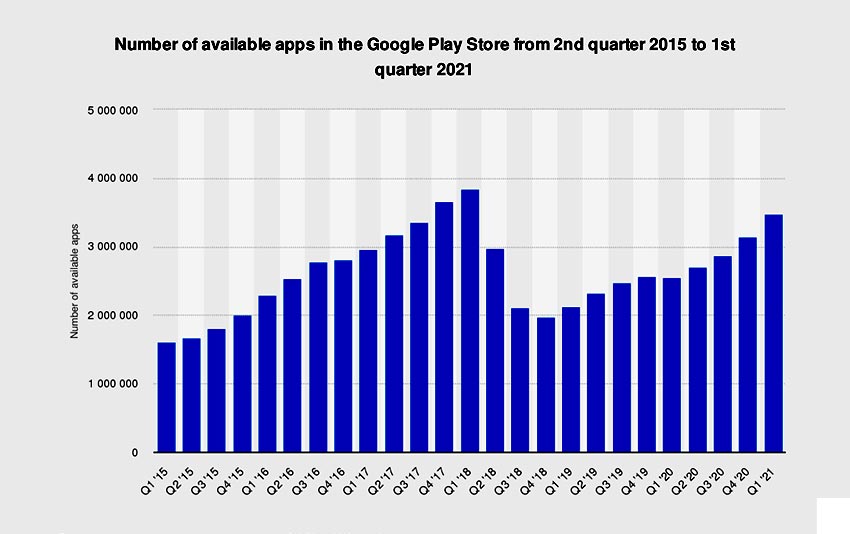

Since mobile phones have been in use for so long, it sounds like an app for almost anything. However, investors are unlikely to put money into a pre-existing app concept.

Consequently, doing competitive research on the demographics and target audience of your app’s market is essential.

Examine what other applications and businesses have to offer. Check out offerings from other companies in the same market to ensure your concept isn’t just a glorified version of another company and its products.

You must demonstrate to investors that it is indeed a novel concept prevalent in our daily lives.

Secondly, determine what precise need your application is fulfilling. “What challenge are we addressing?” or “What sets this application-specific and exceptional in comparison to __?” are some issues to discuss before-handed.

These are some of the things that funders will ask you, and there are many more.

They would want to believe that the investment they’re making will be multiplied by the performance of your application.

It is critical that you conduct research and analysis to acquire a better understanding of your app. Investors do not want to invest in a broad concept.

Instead, they want to know who the target market is, what challenges will be addressed, what functionalities your application has, and the checklist of data that may keep piling up.

Scale your concept so that investors may be assured of their funding

#Market Your App

It’s time for us to start marketing the app because now you understand its use. Designing a logo or a domain name for your application lets investors realize that you are serious about your app concept and have put a lot of thought into it.

Marketing will enable investors to picture your project instead of leaving it as a hazy idea. Marketing has been at the heart of any business; while in uncertainty, rely on marketing.

This seems to be valid for your app concept since its marketing will serve as the basis for the remainder of the project development.

Market your application, if it’s a domain name, a website prototype, or a prototype of the app, so funders can visualize your concept and better comprehend what you’re marketing to investors.

#Create Your Sales Pitch

Investors are eventful entities; therefore, you must have a sales pitch before they even consider scheduling a meeting—your business’s sales pitch, similar to a personalized interview. For example – a networking event is the best way of getting next to funders.

Now let’s briefly go over what a sales pitch is.

The sales pitch for your application is a short and succinct description of it. As an example, let’s say you take the lift up to the 30th floor on your way to a client meeting.

You start up a discussion with a prospective investor who enters into the lift. You have about seconds till the lift door is open, and you walk out to your client.

Within these few seconds, you must present your app concept, functionality, and the challenge your app solves.

That’s the catch to schedule another appointment to go through your application for further information and other specifics for the project development.

If you can’t explain your app succinctly within seconds, you should conduct additional research.

You should describe your app sufficiently to entice funders without occupying too much of their time.

Once they’re interested, you’ll have more time in advance to meet to discuss more precise details, such as budget allocation, functionality, Etc.

You’ve given an investor your sales pitch, so they’re keen to learn further. You can have more than seconds to explain your application to the investors during your presentation; thus, you will require a business plan.

A business plan is a discussion that highlights your app’s most comprehensive features and workflows.

Try to avoid fillers in your business plan that obscures the essential value of the app. A business plan is primarily managed like a Powerpoint presentation. However, it does not include the explicit content that will be used in your presentation.

This seems to be an opportunity to present statistics, data, logos, and so forth to offer pictures of what you’re discussing.

Admittedly, the investors can understand and would have requested a copy if they didn’t like to meet you in person.

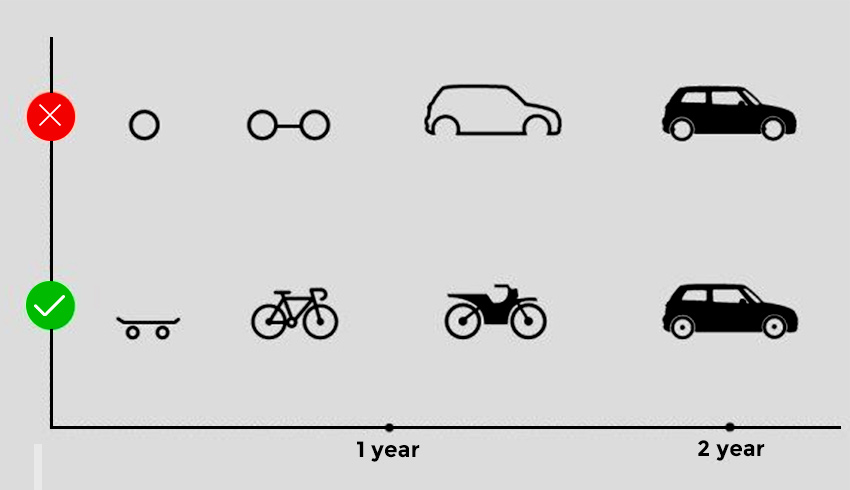

#Create a Prototype/MVP

Similar to how marketing helps investors envision, developing a demonstration or Prototype makes your app accessible. Having a minimum viable product demonstrates your determination to make this application the next great idea.

Also, it enables the investors to get on and experience your concept rather than simply listening to your speech. A prototype of your app might be a simple draft or maybe something you’ve previously released.

It’s crucial to realize that you consider putting obvious flaws and issues to attention if you give an experiential prototype session. Then, investors will be satisfied that you’ve invested so much work in putting your application to reality, regardless of which path you pick.

Interact with Brainvire Infotech to create a fantastic Prototype or MVP to show your investors app ideas.

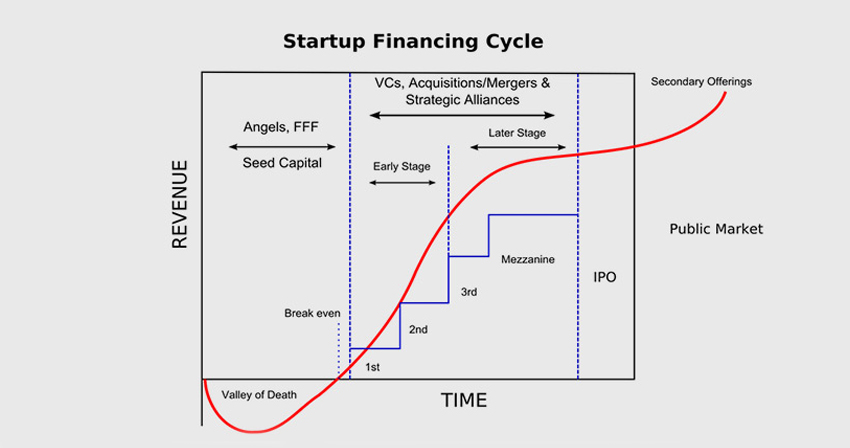

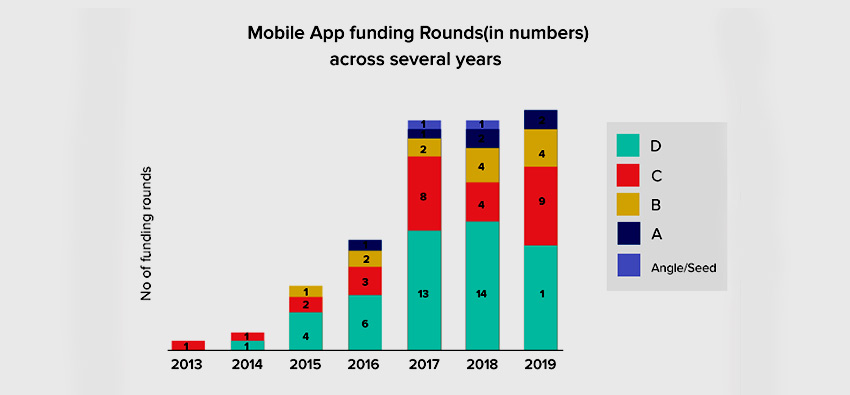

The stages of fundraising are a way to raise money among investors.

There are typically 5 stages that help companies as they progress into an investment from the general public and venture capitalists.

Each stage provides opportunities for feedback, marketing, and media hype for the company. If their product isn’t worth investing in, they will find it out in the early stage and can adjust their product or company.

How to raise money depends on the stage of fundraising you are in. Before they begin, an investor would need to know what exactly they are investing for.

The stages of fundraising include:

- Pre-seed round

- seed round

- series A

- Series B

- C and Beyond

Pre-seed round

Pre-seed round is when companies are just starting out, and they haven’t even thought about raising money.

It’s a round of funding that occurs before the seed stage, often used to establish a company’s product or service.

The investments made into this stage would typically be small, between $100K-$500K. Investors are expected to support companies in the seed and first series of funding.

Pre-seed round is when companies are starting out but haven’t established a product or service yet.

They may have an idea but will need to add more information for people to invest. The first thing they would do is try to get a patent so no one can steal their idea and set up a company that already exists.

If they have a business plan and don’t have an actual product or service, then they would design one in order to present it to potential investors.

The goal for this stage is to raise between $500K-$1 million depending on the market for their product or service.

Seed Round

Investors that invest in seed rounds would-be angel investors and venture capitalists.

The seed round is the first time companies broaden their company size as they start market research and hire professional consultants and corporations.

They will look for investors at this stage because it’s the first time they need a lot of money in order to progress their business.

Investors would expect a 30%-50% return on their investment, depending on the company. If the company fails, then they will lose their investment.

The expected return may be larger because most investors are investing in companies that have a lot of risks involved.

Basic requirements for Seed Round include:

- Market research

- A plan creating an outline of what you are going to do with the money

- Expected revenues that are based on the target market

Following seed investment, you have the opportunity to raise Series A, B, and C rounds from renowned venture capitalists.

This could accumulate over time and amount to tens of millions of dollars:

The next stage is series A, B, and C, in which companies have a more established product or service.

They have already gone through the previous fundraising stages, and now they need less money to market their business to investors using accredited venture capitalists, angel investors, and other private equity firms.

Series ‘A’

Series A is the first time companies are considered serious ventures by investors, which means they have actually launched a product, and it’s being sold, or services have been offered.

This stage would require $1 million to $3 million investment from accredited investors that usually venture capitalists or angel investors.

Why do companies need this much money?

The reason companies require so much money is because they want to hire more employees and even outsource their business. They will spend this money on marketing, advertising, and media hype.

Angel investors would expect a return of 38%-50% because the company has already been established in series A.

Series ‘B’

Series B occurs when companies have already established a product or service and are looking to grow their business.

They will look at private equity firms, venture capitalists, or family offices in order to raise $3 million – $10 million.

The goal is to acquire more customers and investment by the company to start branching out globally, acquiring other companies, forming partnerships with other companies, and even start an accelerator or incubator to get startups.

A company would be able to raise this much money because they wish to acquire other companies, work on their products and services and expand their target market in order to increase their advertising budget.

Angel investors will expect a return of 38%-50% because the company has already established themselves in series B, and the business is profitable.

Series ‘C’

Series C occurs when companies need a lot of money in order to expand and improve their business on a global scale.

This stage would require $5 million-$15 million from accredited investors, like venture capitalists or private equity firms.

They would usually get this much money because they wish to acquire other companies with the help of private equity firms, grow their business globally, increase their advertising budget on an international level, and have experienced management.

Angel investors will expect an expected return of 25%-30% because the company has expanded into a global business. Still, they would like to see how well it does on a global scale before investing so much money.

Additional Information

Approx Time spent developing an app:

- An iOS (Apple) app should take 2-3 months at the cost of $50,000 – $200,000.

- An Android app should take 2-4 months at the cost of $25,000 – $75,000.

- A Windows Phone app should take 2-3 months at the cost of $10,000 – $40,000.

- And an intermediary platform such as Blackberry should take 3-4 months and cost $15,000-$60,000.

App success factors:

In order for a mobile app to succeed, it needs to meet or even exceed the following criteria:

1. Income:

A successful app can provide the creator with transactional income, recurring income, and passive income. Examples of successful apps that have met all three criteria include Groupon, LinkedIn, Dropbox, and Uber.

2. User Base:

The app needs users in order to succeed, so they should be able to download it and use it easily without having any user errors.

3. Customer Feedback:

The app should receive feedback from customers to ensure they are satisfied with the app and want to continue using it – even recommending it to others (word-of-mouth).

4. Ease of Development & Maintenance:

The app needs to be developed in a way that is simple to understand and easy to use.

5. Mobile-Friendly:

The app needs to be easily accessible from any mobile device to reach the largest audience possible.

6. Competitive Advantage:

An app should have an advantage over other apps by offering something unique or providing a better user experience.

7. Credibility:

An app should be credible and provide value to users by previewing the app store, allowing users to read reviews of the app or watch YouTube videos about it before downloading.

8. Customer Reviews:

This will help increase downloads, as well as help customers, make an informed purchase.

App Distribution Channels:

1. Website

A website can be a viable way to promote an app idea, but it is limited. Most consumers prefer to download apps from the app store on their mobile device rather than visit a website.

2. Top Channels:

The top channels for distribution are Google Play, Apple App Store, BlackBerry App World, and Windows Phone Store.

3. Paid Apps

Apps can be downloaded for free if users are willing to wait a certain amount of time (a day or so) before it is unlocked for use. Otherwise, they can pay $1 – $5 directly through their mobile device.

4. Free Apps

With an app, users can download it for free and use it with limited features until they decide to pay for the upgrade.

5. Paid Upgrades

Users have the option of downloading a paid-upgraded version of the app in order to gain more functionality.

6. In-App Purchases

Developers can use a free app with in-app purchases to generate income through micropayments.

7. Freemium Apps

A freemium app can be downloaded for free, but some features are only accessible to users if they pay a fee of some kind.

Conclusion:

Brainvire is a professional Mobile App development company with experience developing Top-grossing applications for iOS and Android, successful launches, and monetizing innovative applications.

We offer an entire spectrum of services, from ideas to launch your application on the market.

We have a team of experienced designers and programmers who know best how to create an application that will become one of the most downloaded in its niche.

We can help you in any stage of development:

Conceptualization, Design, Coding, Testing, Launch, and Promote your app to the world!

Have a good day!

You can do without an investor to start an app. The primary function of an investor is to invest money in your app so it can be funded. Funding is necessary when you need more financial resources to develop your app and take it to the market. If you’re looking for funding, you can start by reaching out to your friends and family, participate in app funding contests, consider crowdfunding or try bootstrapping.

Depending on your app’s stage, you can reach out for funding. Of course, you’ll need to pitch your business with the required data and preliminary research. Once you have all of it ready, the funding options include the following:

– Starting with your network of family and friends

– Venture capitalists

– Participating in app funding contests

– Reaching out to angel investors or Seeds

– Crowdfunding

– Bootstrapping

Typically, the five stages of fund-raising include:

1. Pre-seed round

2. Seed round

3. Series A

4. Series B

5. Series C and beyond

Before you consider pitching your idea for funding, make sure you

1. Understand your app’s market.

2. Start branding and marketing the application along with a prototype for funders to visualize.

3. Create a sales pitch.

The total value of an app is based on its time on the market and user base. A standard method of evaluating your app’s worth is multiplying the average monthly revenue by a specified number of months.

App worth = Avg. monthly revenue * No. of months

Related Articles

-

A Step-By-Step Tutorial On Creating A Taxi App Similar To Uber

People living in cosmopolitan cities where the highways are crowded, and the spaces are not available refuse to drive a car in favor of rides like Uber. The growing demand

-

React vs. Angular – Select The Best for Mobile App Development

The mobile app market has been evolving through the years, and everyone jumping on the digital bandwagon isn’t helping. At the moment, over 100 Billion apps are popular in the

-

Mobile App Design – pitfalls to avoid

Mobile app design can get messy if you do not follow all the design guidelines. Getting the design right will help you avoid mistakes that can lead to a messy