About

The client is a leading Philippines financial services provider who believes in utilizing technology to its best to prioritize customer service. Their clientele includes BPOs that cater to the global market and corporations that leverage technology for growth and strive for progress, essentially, enterprises with demanding system requirements. They deliver whatever their clients imagine. So, they wanted an advanced ID Similarity Matching System.

Project Highlights

The “ID Similarity Matching System” is an innovative and robust software solution designed to address the complex challenges of accurately comparing and matching diverse identification (ID) proofs. Leveraging the power of advanced technologies such as OpenCV, Optical Character Recognition (OCR), Regular Expressions (RE), and Pandas, this product offers a comprehensive approach to identity verification and fraud detection. The system accurately extracts, analyzes, and compares visual and textual attributes from various ID proofs while accounting for contextual nuances and regional differences.

The Challenges

- Attribute Extraction:Accurate attribute extraction across varying formats, layouts, and visual attributes.

- Visual and Textual AttributesExtracting and comparing visual and textual elements in ID proofs.

- Distinction Between Real and Fake IDsEnsuring maximum accuracy in identifying fraudulent documents while minimizing false positives and negatives.

- Accurately Detecting Issue DatesAccurately capturing attributes such as issue dates or document numbers is crucial.

Tech Stack

Python

Jira

AI/ML

Django

Azure DevOps

AWS ECS Docker

Open CV

OCR

Pandas

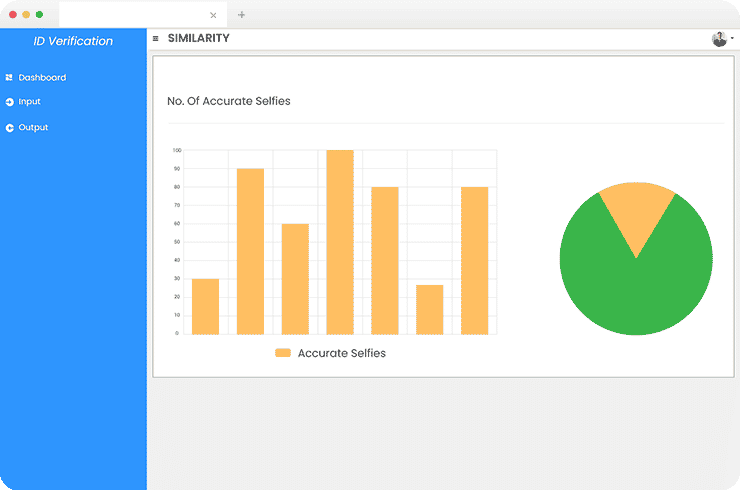

Result

Increased Operational Efficiency

Developing a classification step at an initial stage enabled the client to classify and accurately identify different types of ID proofs, such as passports and driver’s licenses. It reduced the chances of errors and helped the client increase their efficiency.Comprehensive Approach to Extract and Compare Attributes

Optical Character Recognition (OCR) system implementation allowed the client to accurately extract textual elements like names, addresses, document numbers, issue dates, expiration dates, and any other relevant textual information in the ID proofs.Reduces the Risk of Fraudulent Activities

The machine learning models and advanced techniques integration significantly improved the system’s ability to identify fake ID proofs, even sophisticated forgeries. It reduced the risk of fraud, protecting the business from potential liabilities. Moreover, the machine learning models and adaptive techniques are scalable and can efficiently handle large volumes of ID proofs without compromising accuracy.Accuracy and Consistency

Successful OCR implementation enabled the client to accurately extract textual attributes, such as issue dates, document numbers, and other contextual information from ID proofs while ensuring consistency regardless of fonts, sizes, or formatting variations. Regular Expressions (RE) patterns enabled the identification of specific attributes like dates and document numbers based on predefined formats.