Table of contents

The Importance of AI-Powered Payment Solutions

Integration of AI into Conventional, Digital, and Emerging Payment Solutions

The Influence of AI on Payment Participants

Cutting-edge AI-Powered Payment Solutions Examples

FAQs

From time to time, new "groundbreaking technologies" are introduced globally, promising to revolutionize and transform our operations. AI and machine learning have rippling effects on every business. No wonder it has emerged as the latest buzzword, taking the world by storm!

Given how AI is making its presence felt in every industry and sector, how could payment and point-of-sale systems be left behind? As AI advances, it allows creative solutions that enhance the payment experience for both companies and consumers.

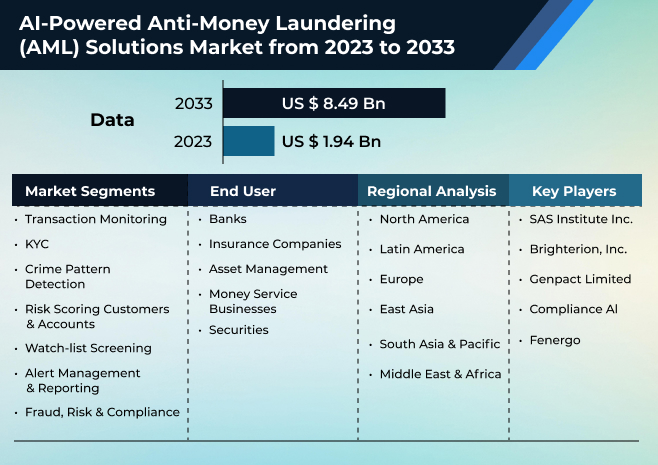

Mordor Intelligence estimates that the AI payment industry will rise by more than 20% CAGR between 2022 and 2027. AI's capacity to improve critical payment aspects, such as fraud detection, customer service, underwriting, and more, drives this increase.

Ref: https://www.factmr.com/report/ai-based-anti-money-laundering-aml-solutions-market

For small company directors, the earlier you learn about AI, the more advantages you will receive. AI has many applications, ranging from fraud detection to improved customization.

This is not to say that AI is risk-free; whether you are a fan or not, it is critical to begin understanding how AI might affect your organization.

In this article, we will look at AI's advantages, dangers, and uses in the payments business.

Let's dive in!

The Importance of AI-Powered Payment Solutions

In the fast-changing environment of digital transactions, incorporating AI into payment processing is critical as organizations across sectors grapple with the obstacles and limitations associated with conventional payment systems. Adapting AI enables organizations to make transactions smarter, quicker, and more secure. Many sectors, like retail and banking, are eager to apply artificial intelligence to overcome difficulties and increase operational efficiency and overall customer experience.

Let's examine why AI deployment has become vital in several industries to enhance payment procedures and corporate operations.

Integration of AI into Conventional, Digital, and Emerging Payment Solutions

AI is transforming the payment environment by providing unique fraud detection, transaction analysis, customization, and customer assistance benefits. Businesses are taking note, with more than 60% thinking AI will boost efficiency and customer connections.

As organizations adopt AI-driven solutions, they will be better able to improve security and compliance and provide seamless, customized experiences that will set them apart in an increasingly competitive market.

It's time to include AI in both conventional and digital payment systems and all future options. Let's examine the development of payment methods to understand why the search for better, quicker, and safer payment choices is critical.

AI's Role in Conventional Payment Methods

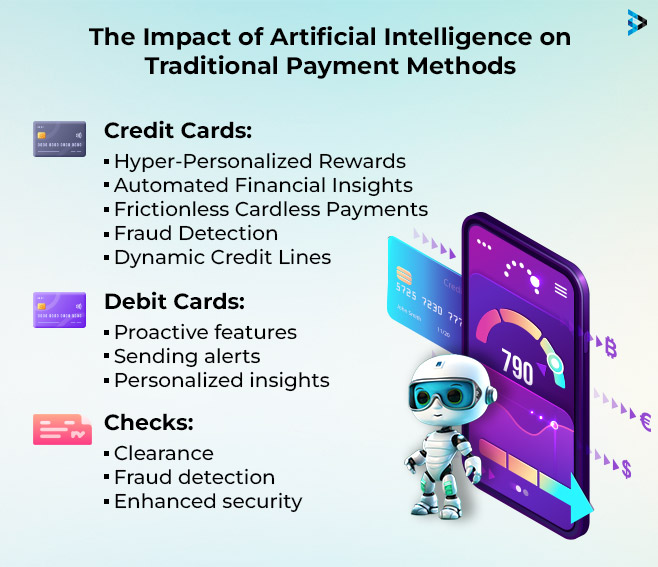

Credit Cards:

The credit card processing industry embraces AI to efficiently handle extensive data, transactions, and processing frameworks. AI enhances data processing capabilities, reduces processing times, and ensures regulatory compliance.

- Fraud Detection on Steroids: AI-powered algorithms bolster fraud detection capabilities, identifying suspicious activities with heightened accuracy and speed.

- Dynamic Credit Lines: AI-driven credit scoring models offer dynamic credit limits tailored to individual spending patterns and financial behaviors.

- Hyper-Personalized Rewards: AI analyzes spending habits to offer personalized rewards and incentives, enhancing customer loyalty and satisfaction.

- Automated Financial Insights: AI-powered analytics provide real-time financial insights, empowering users with personalized recommendations and budgeting assistance.

- Frictionless Cardless Payments: AI-enabled technologies facilitate seamless and secure cardless transactions, enhancing convenience and reducing reliance on physical cards.

Debit Cards:

AI revolutionizes debit card usage with proactive features. It prevents overspending by analyzing spending patterns and sending alerts. Smart budgeting tools automate budget creation and adjustment based on individual habits. Financial well-being coaching offers personalized insights, while instant cash flow analysis provides real-time visibility into financial transactions, empowering users to make informed decisions.

Checks:

AI is transforming traditional payment methods like checks. It expedites processing and clearance, reducing transaction times. AI algorithms detect fraud at the source, enhancing security. Seamless digital check conversion simplifies transactions, integrating paper-based payments into digital systems for enhanced efficiency and convenience.

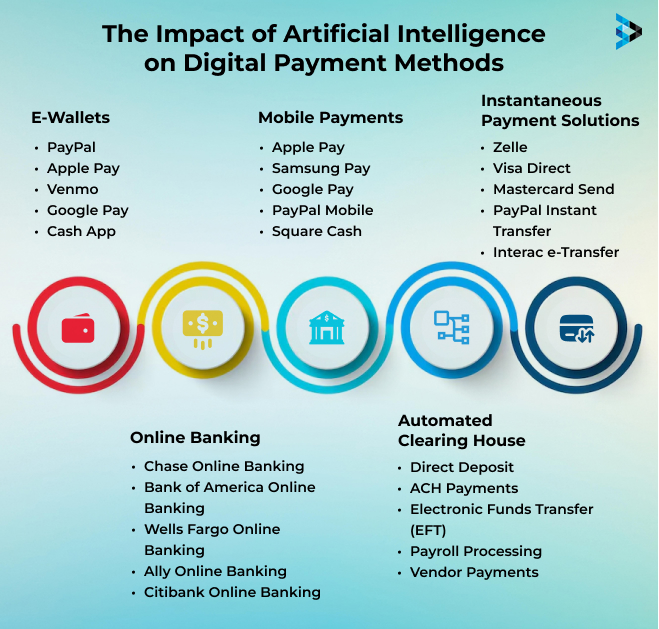

AI's Impact on Digital Payment Methods

Digital wallets represent applications tailored to leverage the capabilities of mobile devices, enhancing access to financial products and services. By securely and efficiently storing all payment information, they effectively eliminate the necessity of carrying a physical wallet for consumers. This compact and secure storage solution streamlines transactions, offering convenience and ease of use in managing financial affairs through mobile platforms.

E-Wallets

Customers can conveniently utilize internet-based digital wallets to securely store credit or debit card details within their accounts or profiles. This innovative technology empowers them to make online transactions without divulging their card information to the merchant's website.

Noteworthy examples include PayPal, Google Wallet, and Apple Pay, which operate smoothly across various platforms without necessitating dedicated applications or device-specific purchases. These platforms streamline the payment process by seamlessly integrating with customers' online profiles and securely storing their payment information for hassle-free transactions.

Mobile Payments

The acronym NFC stands for Near Field Communication. This technology allows wireless devices to communicate and share information. It's simple to use and is becoming popular for mobile payments with mobile app development technologies.

Examples of NFC payment applications include the following:

Apple Pay.

It is designed specifically for iPhones and Apple Watches and allows you to conduct safe transactions by touching your devices near NFC terminals. Card information saved in Apple Wallet is protected by Touch ID or Face ID, and payments use tokenization for further protection.

Google Pay.

It enables quick and safe NFC payments. Card data, like Apple Pay, may be saved in the app and validated using a fingerprint or PIN. Tokenization is the key to ensuring transaction security. Google Pay's tap-to-pay functionality is presently only available on Android smartphones.

Samsung Pay.

Samsung Pay stands out for its use of Magnetic Secure Transmission (MST) technology in addition to NFC. This enables Samsung devices to simulate classic card strips. Because of its adaptability, Samsung Pay is compatible with previous terminals.

Enhanced Online Banking Transfer Experience

Online banking transfers enable seamless fund transfers between accounts, providing convenience and flexibility for users to manage their finances.

Streamlined Automated Clearing House (ACH) Payments

ACH payments offer a reliable and efficient method for processing large volumes of transactions, such as payroll deposits, bill payments, and bank-to-bank transfers. For employees, understanding what is a pay stub is crucial, as it helps track earnings and ensure accurate payments.

Instantaneous Payment Solutions

Real-time payment solutions like Zelle and Faster Payments enable instant fund transfers between individuals and businesses, enhancing speed and efficiency in financial transactions.

Innovative AI-Enabled Payment Solutions

In an era of rapid technological advancement, AI is reshaping the landscape of payment solutions. AI integration enhances security, convenience, and efficiency from traditional methods to futuristic innovations.

| Payment Solution | Description |

| Buy Now, Pay Later (Bnpl) | AI-driven algorithms assess credit risk, personalize offers, and automate payment schedules for seamless transactions. |

| Cryptocurrency Payments | AI enhances cryptocurrency security through advanced encryption and fraud detection algorithms. |

| Open Banking Platforms | AI-powered analytics facilitate data aggregation, personalized financial insights, and streamlined bank transactions. |

| Biometric Authentication Payments | Utilizing biometric data, AI ensures secure and convenient payment authentication, minimizing the risk of fraud. |

| Voice-Activated Payments | AI-powered voice recognition technology enables hands-free, intuitive payment experiences via smart speakers and devices. |

| Subscription Management Platforms | AI optimizes subscription models, predicting user preferences, managing renewals, and enhancing customer retention. |

The Influence of AI on Payment Participants

Consumers

With the integration of AI into payment systems, consumers experience a multitude of benefits. Enhanced security measures ensure peace of mind during transactions, protecting sensitive information from potential threats. Moreover, AI facilitates personalized experiences by analyzing consumer behavior, preferences, and purchasing history, leading to tailored recommendations and offerings. Frictionless payments streamline the checkout process, eliminating hurdles and enhancing convenience for consumers.

Banks

AI revolutionizes banking operations by significantly reducing fraud losses through advanced fraud detection algorithms and real-time monitoring systems. Improved risk management strategies leverage AI-powered analytics to assess and mitigate risks effectively. Additionally, AI enables banks to optimize costs by automating routine tasks, enhancing operational efficiency, and allocating resources more efficiently.

Merchants

Merchants benefit from enhanced fraud protection mechanisms integrated into payment systems, safeguarding against fraudulent activities and minimizing potential losses. AI-driven technologies enable faster transaction processing, reducing wait times and improving overall customer experience. Furthermore, merchants gain valuable customer insights through AI analytics, enabling personalized marketing strategies and enhancing customer engagement.

Fintech Companies

AI is a cornerstone for fintech companies seeking competitive differentiation in the market. By leveraging AI capabilities, these companies can expand their market reach and offer innovative solutions tailored to customer needs. Data-driven innovation fuels the development of new products and services, driving growth and sustainability in the rapidly evolving fintech landscape.

Travel and Hospitality

AI enables dynamic pricing strategies and personalized offers in the travel and hospitality sector, optimizing revenue generation and enhancing customer satisfaction. AI-powered solutions facilitate frictionless airport and hotel experiences, simplifying check-ins, bookings, and other processes. Moreover, AI plays a crucial role in fraud prevention for high-risk transactions, ensuring secure transactions for businesses and consumers.

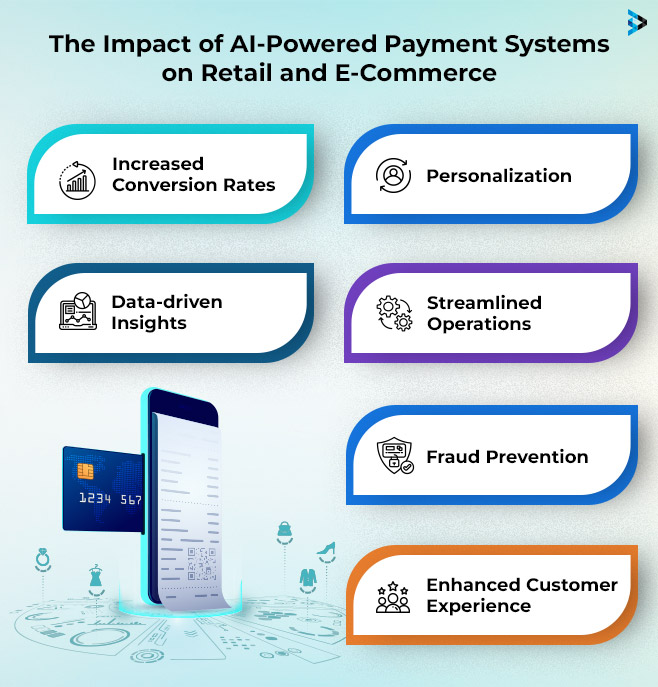

Retail and E-Commerce

AI transforms retail and e-commerce by delivering hyper-personalized recommendations and loyalty programs, fostering customer loyalty and retention. Predictive inventory management powered by AI algorithms minimizes stockouts and overstock situations, optimizing inventory levels and improving supply chain efficiency. A seamless omnichannel shopping experience is achieved through AI integration, enabling customers to transition effortlessly between online and offline channels.

Healthcare

AI accelerates billing processes in the healthcare sector, leading to faster and more accurate billing cycles. AI-driven analytics makes personalized payment plans and financial assistance options possible, catering to individual patient needs and financial circumstances. AI-powered fraud detection algorithms enhance the security of medical insurance claims, mitigating fraudulent activities and protecting patient data.

Education

AI simplifies tuition payments and financial aid management in the education sector, streamlining administrative processes and reducing manual errors. Micropayments for online learning platforms enable flexible payment options, enhancing accessibility to educational resources. Personalized learning experiences are facilitated through AI-driven adaptive learning technologies, catering to students' unique learning styles and preferences.

Cutting-edge AI-Powered Payment Solutions Examples

Revolut's AI Scam Detection: Shielding Customers from Fraud

Revolut pioneered a fraud prevention breakthrough with its latest AI-powered scam detection feature, which shields customers from card scams. By harnessing sophisticated machine learning algorithms, Revolut's system can swiftly identify potential scam scenarios, disrupting the scammer's tactics before any funds are transferred.

Developed in-house by Revolut's financial crime experts, this innovative feature analyzes transaction patterns to gauge the risk of a scam, subsequently declining suspicious payments and guiding customers through a scam intervention process within the app. Revolut empowers users to recognize and resist scams through tailored educational content and expert support. Since its introduction, this feature has already demonstrated significant success, with a 30% reduction in fraud losses attributed to card scams involving investment opportunities.

Innovative AI Payment Solutions by Klarna

Klarna, a trailblazer in AI-powered payment solutions, continually innovates to redefine the shopping experience. Leveraging AI, Klarna's latest offerings include a groundbreaking shopping lens feature, enabling users to snap, search, and shop anything around them effortlessly.

Shoppable videos merge social and e-commerce seamlessly, driving engagement and conversion rates. Moreover, Klarna's in-store scanning feature gives consumers instant access to detailed product information, revolutionizing the brick-and-mortar shopping experience.

Mastercard's AI Scam Detection: Revolutionizing Fraud Prevention

Mastercard's AI-driven Consumer Fraud Risk solution revolutionizes scam prevention by enabling real-time detection of fraudulent payments. Partnering with major UK banks, including TSB, Mastercard's technology analyzes payment data and behavioral patterns to identify and intercept scams before funds are lost. Early adoption by TSB resulted in a significant increase in fraud detection, potentially saving £100 million across the UK. Purchase, impersonation, and romance scams are among the targeted fraudulent activities.

- Real-time scam detection leveraging AI

- Partnerships with major UK banks for widespread adoption

- Success in preventing various scam types, including purchase, impersonation, and romance scams

Capital One's Eno: AI-Powered Virtual Assistant

Capital One exemplifies a bank that leverages AI to enhance customer service. In 2017, it introduced Eno, a virtual assistant accessible via mobile app, text, email, and desktop. Eno handles various tasks such as responding to inquiries, issuing fraud alerts, managing credit card payments, monitoring account balances, and reviewing transactions. Remarkably, Eno communicates with users in a human-like manner, including using emojis.

FAQs

1. How Effective Is AI at Detecting and Preventing Fraud in Real-Time Transactions?

Using AI to identify fraud is the most effective way to safeguard financial transactions from fraudulent activity. With its capacity to analyze massive volumes of data in real-time, spot trends, and respond to changing risks, AI in finance provides unrivaled capabilities to financial organizations trying to secure their assets and clients.

2. Can AI Accurately Assess Creditworthiness and Adjust Credit Limits Dynamically for Individuals and Businesses?

AI systems can examine enormous amounts of data, resulting in a more accurate evaluation of a person's creditworthiness. This enables lenders to make more informed loan choices, reducing the risk of default.

3. How Can AI be Used to Automate Various Tasks and Streamline the Payment Process, Leading to Faster Transactions?

AI algorithms evaluate and optimize transaction pathways, ensuring that your payments go the quickest and most efficiently from your wallet to the receiver. This leads to faster processing times and eliminates needless delays.

4. What Are the Possibilities for Using AI to Personalize the Payment Experience and Offer Tailored Rewards Programs or Financial Insights?

Machine learning algorithms analyze prior purchases and internet behavior to create specific consumer profiles. AI then determines appropriate payment options, value-added services, future promotions, and purchase recommendations based on customer requirements and preferences.

5. How Can AI be Integrated with Emerging Payment Technologies Like Contactless Payments, Digital Wallets, and Open Banking Platforms?

AI may analyze client data to deliver customized payment experiences, such as proposing the best payment method or giving bespoke incentives. It may also automate mundane processes such as transaction processing, data input, and customer verification, freeing up human resources for more sophisticated work.

6. What Are Some of the Most Innovative AI-Powered Payment Products or Services Available in the Market?

Some of the most innovative AI-powered payment products or services currently available in the market include HighRadius, Signifyd, DataRobot, Ocrolus, SAP, Upstart, Brighterion, Amazon Web Services (AWS), Microsoft Azure, and Salesforce. These companies leverage AI to transform finance processes, enhance security, automate tasks, and deliver better customer experiences in the financial services sector.

7. How Can We Prepare for the Ethical and Regulatory Challenges That May Arise with the Increasing Use of AI in Payments?

A robust AI code of ethics may prevent prejudice, protect user and data privacy, and limit environmental dangers. AI ethics may be applied in two ways: via company ethical codes and government-led regulatory frameworks.

8. How Will Advancements in AI Technology, Such as Natural Language Processing or Deep Learning, Further Impact the Future of Payments?

AI, which uses natural language processing, allows frictionless chat-based transactions and a thorough study of consumer language patterns, resulting in more intuitive customer experiences. AI algorithms are reducing the payment chain, which means faster transaction times and fewer possible sites of mistake or fraud.

Related Articles

Digital Transformation

AEM Implementation Cost Insight: Everything You Need to Know

Digital Transformation

AEM Implementation Process, Best Practices, and Tips

Digital Transformation

Odoo Pricing Guide: A Comprehensive Breakdown