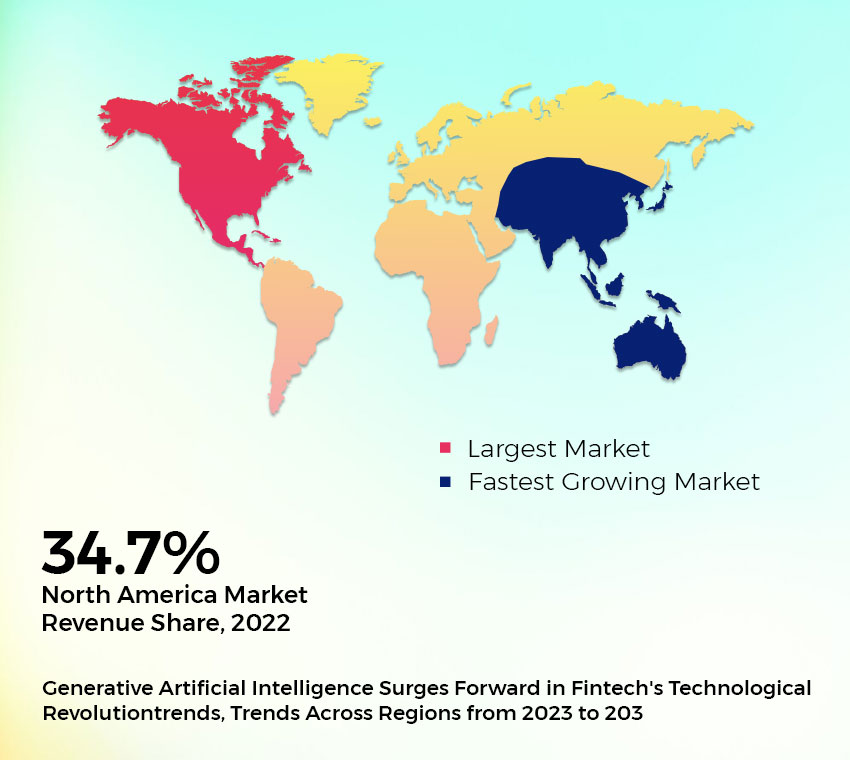

From the realms of creative arts to eCommerce and software engineering, the transformative power of generative AI— exemplified by technologies like ChatGPT—can revolutionize our lifestyles and professional landscapes.

Its application within fintech stands as a prime testament, with automation capabilities evolving into increasingly intricate functionalities.

A recent McKinsey report underscores this potential, highlighting that generative AI has the capacity to unlock an annual value nearing $340 billion within the banking sector alone.

Furthermore, Nvidia reveals that a staggering 91% of financial enterprises experience tangible enhancements upon integrating AI solutions.

Simply put, machine learning (ML) and deep learning (DL) empower financial firms to boost profitability and expand their market presence.

Specifically, generative AI stands out in fintech support, dramatically elevating the possibilities within customer experience (CX) automation.

Leveraging Generative AI's Power in Fintech Innovation

Indeed, the rise of generative AI has revolutionized the support automation landscape. A Zendesk study revealed that a significant 67% of surveyed customers favor self-service options over engaging with human representatives. Concurrently, numerous LinkedIn discussions emphasize the risks companies face by neglecting AI integration in their operations.

Staying ahead of the technological curve is imperative in competitive sectors like fintech. It's not merely about embracing the trend; empirical data reveals that automation applications are evolving swiftly and gaining traction. Notably, AI adoption in financial services surged by 63% just last year. With the integration of generative AI, this momentum is poised to escalate further.

Beyond the buzz and grandiose assertions, you might be seeking clarity on how generative AI specifically impacts fintech. Let's take a closer look at that.

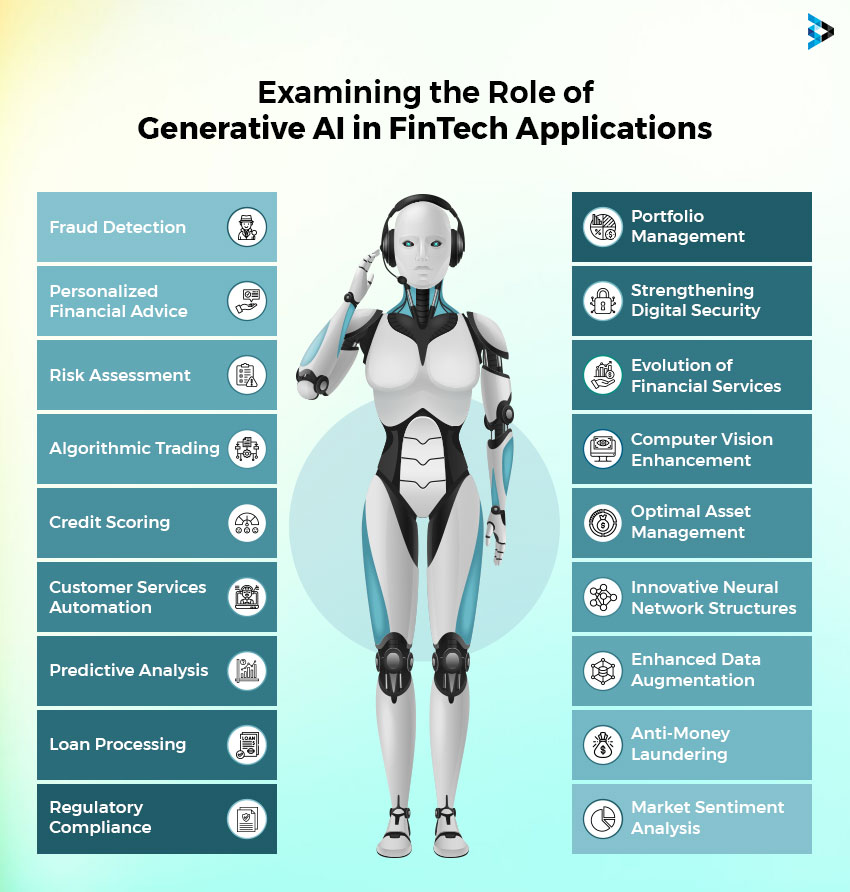

Generative AI Use Cases in Financial Services

Generative AI possesses the capability to generate unique content and data, offering multifaceted advantages across various industries. Its versatility in producing diverse content formats can revolutionize sectors in distinct ways.

For example, generative AI can refine product design and streamline processes in manufacturing. Moreover, it plays a pivotal role in risk management by creating synthetic data for comprehensive risk evaluations. Let's explore the transformative impact of generative AI in finance.

-

Fraud Detection

There’s no doubt that generative AI has the capability to analyze vast volumes of financial data, identifying patterns and anomalies indicative of fraud. By harnessing this advanced technology, financial institutions can bolster their fraud detection and prevention protocols, safeguard customer assets, and uphold the financial system's integrity.

- While traditional methodologies like rule-based systems and statistical models leaned heavily on predefined rules and patterns to flag potential fraudulent activities, contemporary approaches leverage sophisticated machine learning algorithms.

- Today, techniques such as support vector machines, random forests, and neural networks are employed for fraud detection. These algorithms undergo rigorous training on extensive datasets, enabling them to discern patterns and detect anomalies in real time.

Considering both time efficiency and reliability, the superior choice becomes evident.

-

Personalized Financial Advice

Investors often want individualized financial advice that aligns with their objectives and risk tolerance. Generative AI may use data from various sources, such as market patterns, economic indicators, and individual financial profiles, to deliver individualized investment advice. Gen AI may provide insights that enable investors to make well-informed judgments by considering various aspects.

-

Risk Assessment

Lending entities encounter the complexity of precisely gauging credit risk. Generative AI simplifies this by analyzing an individual's financial background, expenditure patterns, and other key indicators to determine creditworthiness. Consequently, this streamlines loan approval processes and reduces the likelihood of defaults.

-

Algorithmic Trading

Algorithmic trading swiftly assesses market data, identifies trends, and leverages generative AI to make instantaneous decisions. By harnessing the capabilities of generative AI, businesses can automate trading activities and execute transactions rooted in data-driven insights. This approach not only enhances productivity but also boosts revenue potential.

-

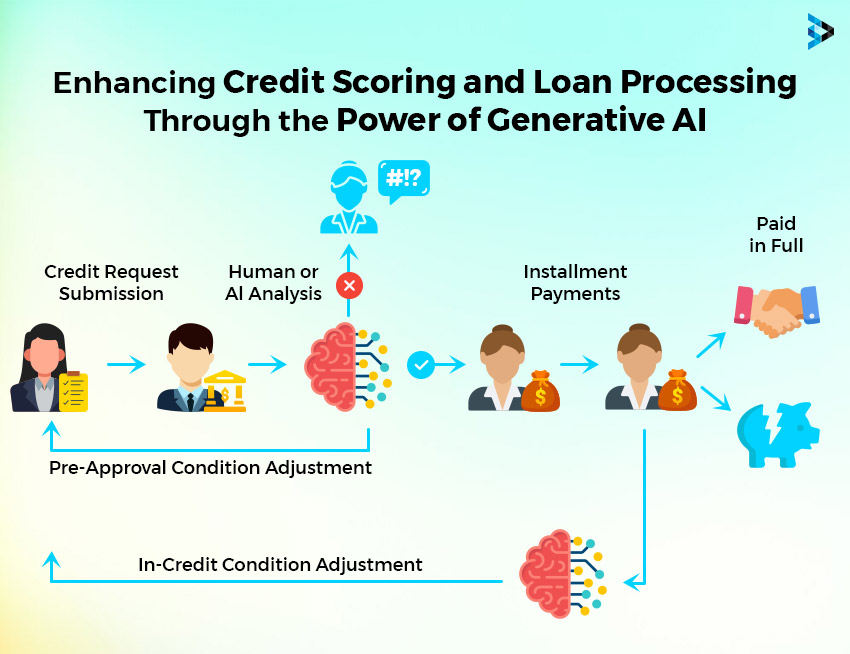

Credit Scoring and Loan Processing

AI algorithms possess the capability to proactively and accurately flag potential customers with a higher risk of loan default. AI can identify potential defaulters before loan approval through a detailed analysis of demographics, income levels, credit histories, and even social media interactions. Early detection is crucial in mitigating financial losses from potential bad debts.

Furthermore, AI-driven predictive models are not static entities; they dynamically evolve by incorporating fresh data and adjusting to economic climates and consumer behavior shifts. This continual learning and adaptability position AI as an indispensable tool for financial institutions striving to maintain a competitive edge in the ever-changing credit and lending landscape.

-

Customer Services Automation

- Users increasingly expect rapid responses to their queries; financial institutions must be available year-round to address user questions promptly.

- In fintech, AI enhances availability by offering continuous customer service, reducing reliance on human agents.

- AI-powered chatbots can mitigate the risk of losing customers to competitors by ensuring constant availability and immediate responses.

- Chatbots, interfaces, and virtual assistants streamline customer service tasks, managing common concerns and addressing general user queries.

- The evolving role of AI in fintech demonstrates its potential to reduce workload, enhancing efficiency and user satisfaction significantly.

-

Regulatory Compliance

By scrutinizing legal standards, GenAI detects possible compliance concerns, ensuring rigorous adherence to financial regulations. Utilizing GenAI can minimize the likelihood of compliance breaches by automating and maintaining ongoing monitoring for compliance.

-

Portfolio Management

Analyzing market trends, investment strategies, and risk elements, generative AI assists in portfolio management. By providing investors with real-time data and recommendations, generative AI supports them in optimizing investments and making informed decisions in the realm of investing.

-

Evolution of Financial Services

Generative AI offers diverse applications within FinTech, from refining chatbot interactions and elevating customer satisfaction to creating synthetic data, identifying fraud, forecasting trading results, and modeling risk elements.

-

Computer Vision Enhancement

Generative AI can potentially transform computer vision capabilities in the FinTech sector. Through the use of generative AI, organizations can swiftly process visual data, facilitating automated tasks such as image recognition, object detection, and facial identification.

-

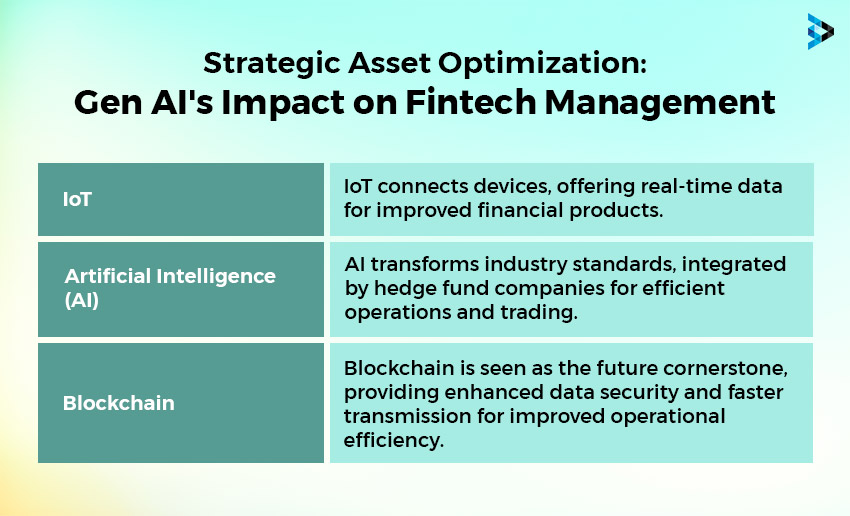

Optimal Asset Management

The financial business is presently experiencing a competitive environment with expanding clients. This results in an inexorable march of asset and investment management towards digitization, particularly to keep up with the introduction of new trends such as the IoT, cryptocurrencies, and so on.

-

Innovative Neural Network Structures

Neural networks are an advanced subset of AI algorithms, comprising interconnected processors called neurons that handle input, processing, and output tasks. The accuracy of predictions improves with superior training data quality. Within FinTech, neural networks prove invaluable for predictive tasks like forecasting stock market trends, assigning bond ratings, and evaluating debt risks.

A particularly beneficial application of neural networks in FinTech lies in risk management, specifically assessing the risks tied to individual financial transactions. For instance, lending companies aim to ascertain that borrowers are likely to repay their loans punctually, as repayments optimize profitability for these institutions.

-

Enhanced Data Augmentation

Generative AI enriches the fintech sector's existing databases, amplifying the available data for refinement and validation. Generative AI helps overcome limitations arising from inadequate or skewed datasets by generating artificial data points.

This approach elevates the performance of AI models by expanding the training data, ensuring more reliable generalizations for real-world scenarios.

With enhanced data augmentation, fintech firms can achieve more accurate predictions, detect anomalies effectively, and conduct comprehensive risk assessments.

-

Anti-Money Laundering

Addressing money laundering is a paramount concern for financial institutions. Generative AI plays a crucial role in pinpointing potentially illicit transactions by recognizing patterns that diverge from typical behavior. Adopting this proactive strategy amplifies the effectiveness of anti-money laundering initiatives and mitigates regulatory vulnerabilities.

-

Market Sentiment Analysis

Market sentiment significantly influences investment choices. Generative AI excels in evaluating social media, news content, and various other sources to precisely assess market sentiment. Such insights empower investors to make well-informed decisions and anticipate forthcoming market trends.

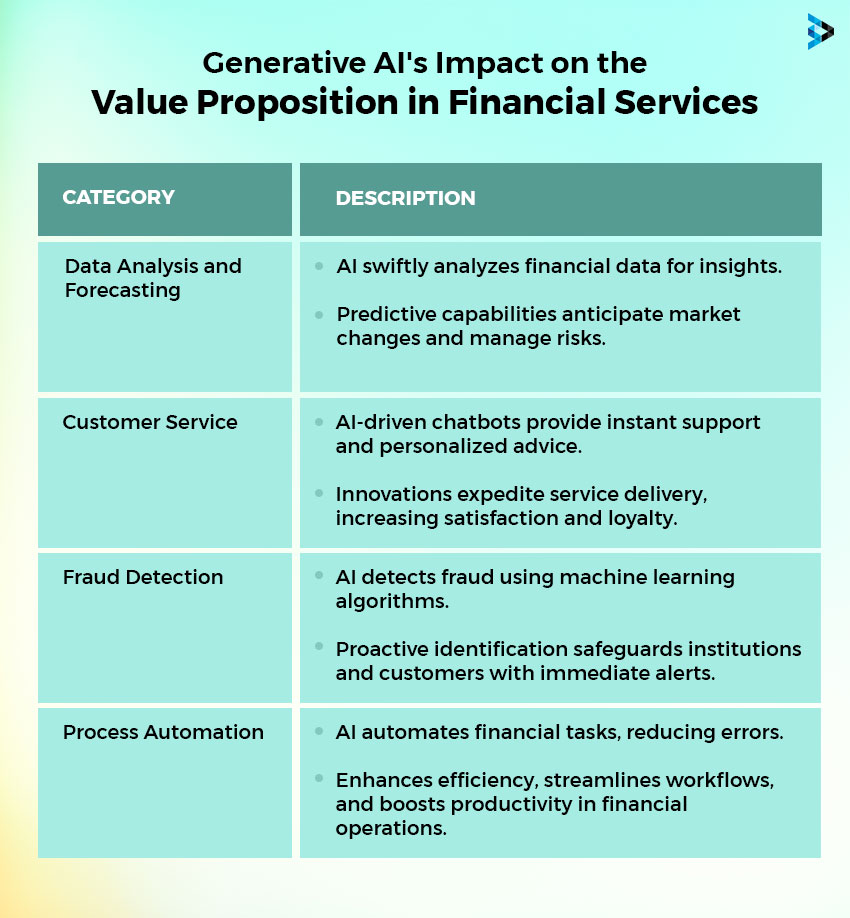

Benefiting Financial Services: Generative AI's Value Proposition

One can hardly deny the impact of Artificial Intelligence on the financial realm. As the use of generative AI grows wider, its transformative effects are anticipated to expand beyond just financial institutions, permeating numerous other sectors as well.

Limitations and Hurdles: Implementing Generative AI in Finance

High Energy Consumption:

Generative AI applications in financial services often demand substantial computational power, leading to increased energy consumption. The intricate algorithms and foundational models strain resources during training and deployment, resulting in elevated costs and internal resource depletion.

Data Quality Impact:

The efficacy of generative AI models relies on the quality of input datasets. In financial services, where precision is paramount, poorly reported data can yield inaccurate outputs. Ensuring high-quality, validated, and vetted input data is essential to mitigate the risk of miscommunications and falsified results.

Cybersecurity Vulnerability:

Generative AI systems in financial services face cybersecurity threats due to their reliance on extensive data, making them potential targets for hackers. Breaches in system security could lead to unauthorized access, financial fraud, and other cybersecurity risks. Robust cybersecurity measures and continuous monitoring are imperative to safeguard system integrity.

Governance and Regulatory Compliance Challenges:

Integrating generative AI solutions in financial services poses governance and regulatory compliance challenges. Institutions must align their actions with industry regulations, addressing concerns such as transparency, explainability, and fairness in the decision-making processes of generative AI systems. Adherence to governance and regulatory requirements is crucial to uphold trust and mitigate potential legal and reputational risks.

Data Privacy and Security Concerns:

Generative AI tools rely on vast datasets, including sensitive and personal information, necessitating stringent data privacy and security measures. Financial institutions must implement robust protection measures, encompassing encryption, access controls, and data anonymization techniques, to ensure the confidentiality and integrity of information and compliance with privacy regulations.

Companies Harnessing Gen AI Propel Financial Solution Innovation

-

JPMorgan Chase: AI Revolutionizes Fraud Prevention Landscape

JPMorgan Chase exemplifies the transformative impact of machine learning on fraud prevention. By harnessing AI to scrutinize customer transaction behaviors, the institution has notably curtailed fraudulent activities associated with card transactions. Remarkably, the bank documented a 50% decline in erroneous fraud alerts, enhancing customer satisfaction and concurrently intensifying anti-fraud measures.

Enter the Era of Generative AI. In contrast to its conventional counterparts that rely predominantly on analyzing pre-existing data, Generative AI possesses the prowess to craft novel data mirroring authentic patterns. This innovation extends to fabricating financial transactions that impeccably replicate genuine customer actions, presenting an invaluable asset in deciphering and preempting novel fraudulent methodologies.

Generative AI empowers financial institutions to replicate intricate and evolving fraudulent scenarios, transcending the confines of existing AI capabilities. Consequently, banks can strategically devise and refine their fraud detection protocols, maintaining a proactive stance against an expansive spectrum of potential illicit activities.

Nevertheless, the adoption of Generative AI in fraud prevention is not without its intricacies. Upholding the ethical deployment of synthetic data, safeguarding customer confidentiality, and adhering to regulatory mandates emerge as pivotal considerations for financial entities capitalizing on this avant-garde technology.

-

HSBC's Amy: Banking's AI Service Star

HSBC employs an AI chatbot named Amy, crafted to guide clients through inquiries, furnish account details, and aid in diverse banking activities.

Amy adeptly manages various customer service functions, from elucidating HSBC's offerings to addressing specific account queries and facilitating transactions. Such proficiency enhances the overall customer service journey.

Utilizing AI-driven chatbots like Amy enables examining customer interactions and data, paving the way for tailored recommendations, solutions, or guidance aligned with an individual's financial aspirations and inclinations. Amy plays a pivotal role in assisting clients to navigate challenges and oversee their accounts with enhanced efficiency.

From executing transactions and disseminating account specifics to addressing queries, integrating these capabilities into a chatbot framework streamlines operations, fostering heightened customer contentment.

-

Deutsche's TDI Division Pioneers AI Innovations Globally

The bank's innovation team, part of the global Technology, Data, and Innovation (TDI) division, is actively exploring and experimenting with AI and generative AI alongside our business and infrastructure units.

Acknowledging AI's vast capabilities, DB is tapping into multiple avenues across its operations. This includes deep understanding of client behaviors and preferences, streamlining operational tasks, and harnessing AI for more informed investment choices. The bank's global focus is on three primary initiatives: crafting software tools to empower developers and enhance productivity, deploying AI chatbots to support employees and clients by interpreting unstructured data and voice inputs, and expediting risk assessment processes.

Read more: Leveraging the Power of Artificial Intelligence in Cybersecurity

FAQs

- What mechanisms are in place to continually evaluate the performance of AI models in fintech applications?

Start with metrics such as accuracy, precision, or F1-score tailored to the specific fintech application. Additionally, evaluate data quality, model intricacy, and fairness indicators to align with business objectives and ethical standards.

- How does generative AI ensure the security of sensitive financial data?

Gen AI safeguards sensitive financial data by employing mechanisms like Sensitive Data Protection. This approach scrutinizes input prompts and generated outputs from foundational models, ensuring the identification or elimination of sensitive elements, thereby bolstering data-centric security controls.

- What technical hurdles might arise when integrating generative AI into existing financial systems?

Integrating generative AI into financial systems presents challenges: data security concerns post-ChatGPT incidents, questions regarding data ownership and IP rights with platforms like OpenAI, potential biases from flawed data inputs, dependence on rapidly evolving AI platforms, scarcity of specialized AI talent, and organizational resistance requiring extensive training.

- How adaptable is AI to various financial environments and systems?

AI exhibits versatility across financial environments and systems by automating workflows, functioning autonomously responsibly, and enhancing decision-making and service provision. For instance, in cybersecurity, AI aids payment providers by persistently monitoring and analyzing network activities.

- Examples of explanations of how Generative AI enhances customer experiences in banking, investing, or other financial services.

Generative AI-driven chatbots engage customers by addressing loan application queries, guiding them on necessary documentation, delivering general assistance, and elevating customer experience and interaction in financial services.

- What APIs and integration tools are available for incorporating generative AI into existing financial systems?

Several APIs and integration tools facilitate the integration of generative AI into financial systems. Platforms like OpenAI provide APIs for accessing models like GPT-3, while cloud providers offer AI services like AWS DeepComposer. Additionally, specialized fintech API platforms offer tailored solutions to embed generative AI capabilities into existing infrastructures seamlessly.

- What are the long-term implications of generative AI for the future of finance and banking?

Generative AI offers transformative advantages in regulatory reporting within finance and banking. It diminishes manual inaccuracies, enhances report precision, and optimizes processes for cost efficiency. Automated compliance mitigates risks, detects potential violations, and maintains compliance with dynamic regulations.

- How can the financial services industry collaborate with academia and research institutions to advance the development and responsible use of generative AI?

The financial sector can collaborate with academia by initiating joint research projects, sharing data ethically, hosting collaborative workshops, establishing internship programs, and co-creating ethical guidelines. Such partnerships facilitate the advancement of generative AI technologies while ensuring responsible and ethical deployment in financial services.

Related Articles

Digital Transformation

AEM Implementation Cost Insight: Everything You Need to Know

Digital Transformation

AEM Implementation Process, Best Practices, and Tips

Digital Transformation

Odoo Pricing Guide: A Comprehensive Breakdown