About Project

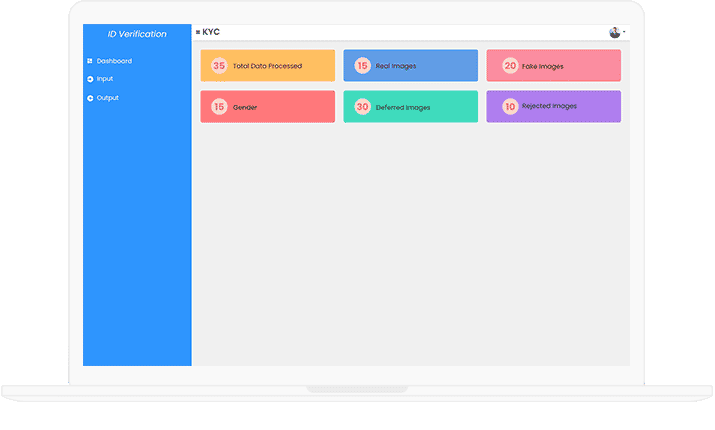

A leading Philippines financial services provider wanted an innovative software solution to streamline and enhance the KYC verification process for organizations. The KYC Verification System is a robust and automated solution designed to verify KYC documents by extracting and validating critical information such as photos, names, and ID numbers from client-provided CSV files. Leveraging the power of TensorFlow, OpenCV, PyTorch, NumPy, and Faster R-CNN, this system streamlines the KYC process while maintaining data accuracy and security.

Web

Platform/OSFinance

Category

Brief

After understanding the client’s requirements, team Brainvire started developing a robust KYC Verification System. They focused on four significant aspects: image preprocessing, object detection, model training and fine-tuning, CSV parsing, and verification. The team employed OpenCV, utilized Faster R-CNN, implemented TensorFlow and PyTorch, and OCR tools to extract text.

Highlights

Team Brainvire delivered an efficient KYC Verification System to the client. The products filled the gap and played an essential role in enhancing the client workflow efficiency and contributed to their business growth. Brainvire always ensures the delivery of the best and fastest solutions to minimize the client’s efforts and make them cost-effective.

Case StudyFeatures

Image Preprocessing:

OpenCV enabled preprocessing images, ensuring optimal input for the object detection model.

Object Detection:

The system identifies and localizes regions of interest (e.g., photos, names, ID numbers) on the KYC documents.

Model Training and Fine-Tuning:

TensorFlow and PyTorch make it proficient in recognizing specific document elements.

CSV Parsing and Verification:

The system parses CSV files to retrieve expected values. OCR tools extract text, and verification logic cross-checks it against expected values.

Tech Stack

Python

Jira

AWS

Django

Azure DevOps

TensorFlow

Open CV