About Project

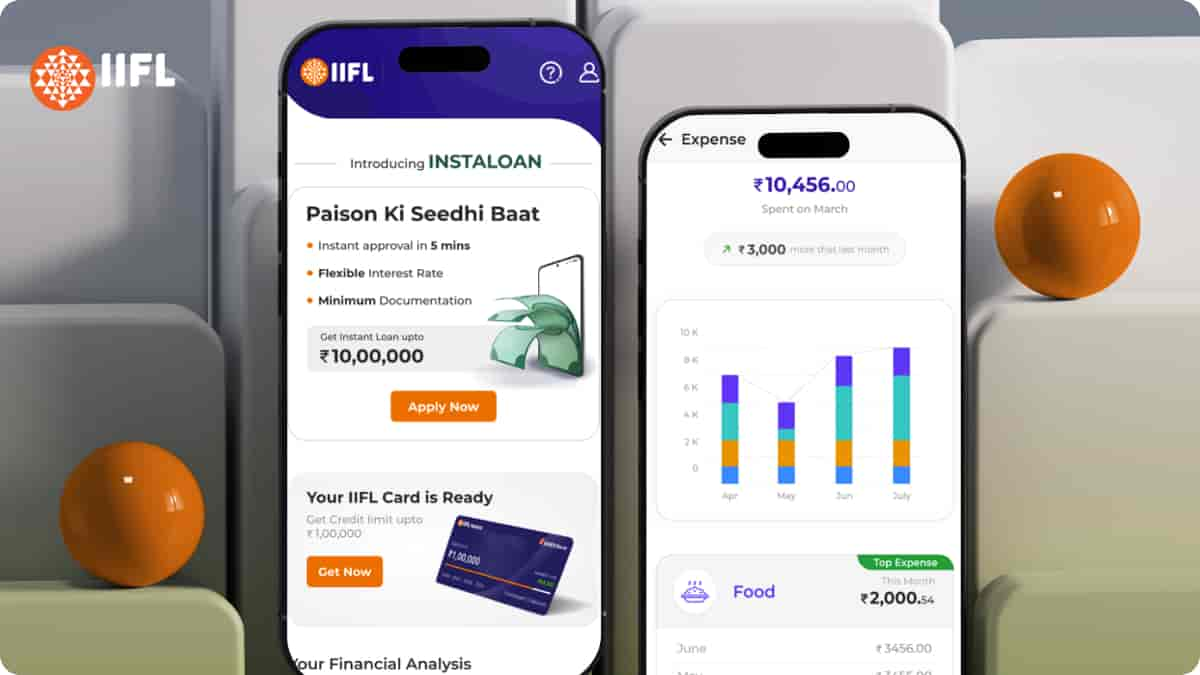

IIFL, a leading financial institution in Asia-Pacific, required a solution to help customers track their income, expenses, and investments effectively. Our team developed an AI-powered mobile app that utilizes intelligent technologies like AI and ML to monitor financial transactions, suggest lucrative investment options, and provide insightful financial guidance.

Financial Services Provider

BusinessAsia-Pacific

Location

Business Goal

The primary goals were to enhance customer experience, streamline financial management, facilitate informed investment decisions, and increase customer retention through a user-friendly and intelligent mobile app solution.

Project Highlights

- Developed AI-driven mobile app

- Enabled intelligent financial tracking

- Personalized investment recommendations

- Facilitated seamless portfolio management

UI/UX Enhancement

Key Challenges

Track Incomes and Expenses

Customers fail to keep track of their different incomes and expenses.

Mutual Fund Investment Tracker

Customers find it difficult to keep tabs on their mutual funds.

Suggested Mutual Funds

Customers struggle to search for a lucrative mutual fund option.

Segregation of Income and Expense

It was difficult for customers to bifurcate their incomes and expenses.

Our Solutions

Developed AI-Powered Income and Expense Tracking via Text Analysis

We leveraged AI and natural language processing to analyze text messages from users’ bank accounts, automatically categorizing and tracking their income sources and expenses. This provided a comprehensive financial overview without manual effort from the users.

Enabled Intelligent Mutual Fund Management

Our solution utilized machine learning algorithms to analyze users’ investment profiles, risk appetites, and financial goals, offering personalized mutual fund recommendations. It also provided real-time portfolio tracking and performance analysis capabilities.

Optimized Predictive Analytics for Fund Suggestions

We employed predictive analytics models to analyze market trends, historical data, and user preferences, suggesting the most suitable mutual fund options tailored to each user’s financial situation and objectives, optimizing their investment decisions.

Offered an AI Solution for Automated Income and Expense Segregation

Our AI-powered solution intelligently segregated users’ income sources and expenses based on transaction patterns, categories, and user feedback, eliminating the need for manual categorization and providing accurate financial breakdowns for better visibility.

Our Approach

We adopted a comprehensive approach leveraging cutting-edge AI and ML technologies.

Data-driven

Personalized

Collaborative

Iterative

Technology Stack

Machine Learning

AI/ML

Mobile Operating System

AI/ML

Key Results

500,000+ Active Users

The app has been widely adopted, with over 500,000 users actively managing their finances.100+ Million USD Managed

The app successfully manages assets worth over 100 million USD, showcasing its effectiveness and reliability.20+ Bank Affiliations

The app is affiliated with over 20 reputed banks, providing seamless financial integration.1 Million+ Transactions

The app has facilitated over 1 million secure and efficient financial transactions.

Social Section

What Our Client Says!

Similar Projects!

Unlock AI-Driven Financial Management

Embrace the future of intelligent financial management and contact Brainvire today!